Table of Content

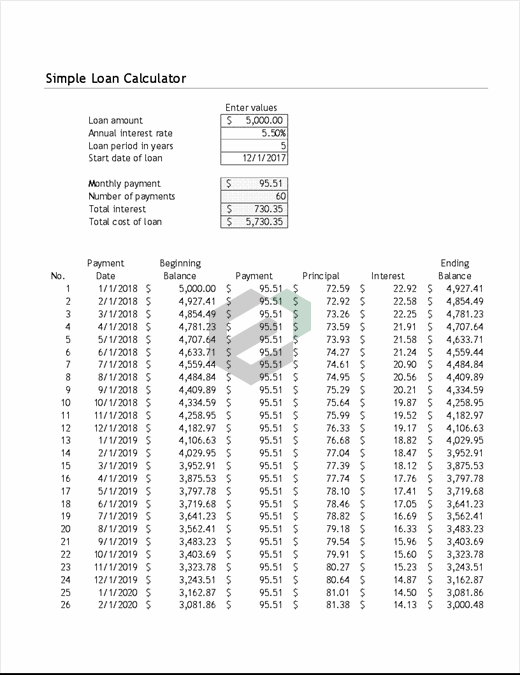

It also helps in finding out savings in terms of paying off the debt early. With EMI repayments, consumers are better able to handle their monthly finances. Banks also offer 'Part prepayments' and 'Full pre-closures' on your loans, which allow you to use the bulk of the sum you may receive during the loan repayment period. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount and determines the portion of one's payment going to interest. Having such knowledge gives the borrower a better idea of how each payment affects a loan.

Obligation to the bank would be terminated only if the full amount in the loan account becomes Zero, if any, on payment of the residual amount. A loan is any money borrowed by an individual or another party. The lender — usually a company, financial institution, or government — provides the borrower with a sum of money. In return, the borrower agrees to a series of terms covering all financial costs, interest, maturity dates and other terms and conditions. In certain situations, the lender may often require collateral to protect the loan and ensure its repayment. Please find the same as an attachment in the mail id shared by you.

What is the EMI structure for an Rs.25 lakhs SBI Home Loan?

Though loans are repaid with monthly EMIs, banks allow you to make occasional additional payments into your loan account that will be adjusted against the principal amount. One can make a partial prepayment or make a full prepayment and foreclose the loan. Though there are no charges for prepayments these days, one should check with the bank for any applicable charges. Equated monthly instalment is a fixed amount you pay to the bank, against a loan taken.

But for comparison purposes, use the SBI Home Loan EMI Calculator to compare various EMIs using different interest rates, loan amounts, and tenures. The SBI Home Loan EMI Calculator provides such an EMI amortization schedule. This schedule breaks down the entire repayment and the borrower can see if they can afford to pay the monthly EMIs.

How is the SBI Home Loan Statement useful?

The SBI Home Loan statement or Repayment Schedule is available all-round the year. You may download it online as per the steps mentioned above, or collect it physically from any SBI Home Loans branch as per their working hours. Magicbricks is only communicating the offers and not selling or rendering any of those products or services. It neither warrants nor is it making any representations with respect to offer made on the site.

In comparison, your credit ratings would also be negatively impacted, which will hinder the chances of obtaining a loan in the future. In addition, you will still have to pay a bounce fee on the return of the instrument. Please refer to our Schedule of Charges for the sum of this fee. Charges @1% on part payment amount will be levied quarterly on Fixed Interest rate car loans, if you opt to make part prepayments within 24 months from the date of disbursement.

Savings Accounts

You should choose tenure that you are comfortable with, keeping in mind the total payout every month. Loan tenure- this tenure is the period within which the borrower needs to pay back the loan amount. The longer the tenure of the loan, the lesser will be the EMI amount.

A penalty of Rs. 250/-will be levied for any bounced check / ECS or SI dishonor. In the case of a check bounce, civil proceedings under section 138 of the Negotiable Instruments Act, 1881 will be launched. Set up NACH mandate to enable auto debit of the EMI amount from your bank account. We send you updates, promotions and offers but you can easily remove yourself from our email list.

Reasons to use the SBI Home Loan EMI Calculator

SBI offers home loans within the range of 10 lakh to 10 Crore . It is a straightforward tool that allows you to calculate SBI home loan EMI in advance on your home loan. You need to fill in your loan amount, tenure, and interest rate to calculate the EMI. Repayment will commence only after one year of course completion.

The EMI amount is calculated by including the accrued interest during the moratorium period and course period along with the principal. You can also avail a second loan on top of the existing loan and extend the repayment by another 15 years of completing the second course. SBI Bank offers many different types of home loans to eligible customers.

In case of any confusion, the borrower can contact the loan officer and get more details about all the applicable charges. Say, the principal amount is Rs.50 lakhs and is taken at an interest rate of 8% per annum. Using an EMI calculator is one of the first steps you take to apply for a home loan and purchase/construct your dream abode. The next steps involve arranging all the necessary documents and making sure you fulfill all the eligibility criteria. SBI easy home loan EMI calculator, by simply entering the loan amount, interest rate and select the loan tenure from drop down. Home loans are one of the sought-after financing options from SBI since this bank offers the most attractive rate of interest.

Using this technique, the loan balance will fall with each payment, and the borrower will pay off the balance after completing the series of scheduled payments. Prepaying a part of your home loan much before the end of its tenure will help to reduce the EMI payments. However, banks will charge a certain penalty fee for prepayment allowance. We have a network of + branches, sales teams and processing centers across the country to cater to the housing loan requirements of individual customers. Please click here to locate us and contact us for your home loan requirements.

No comments:

Post a Comment